Barcode Label Printer Market Size and Growth Outlook

Grand View Research projects the global barcode label printer market to climb from 4.7 billion 2024 to 7.5 billion by 2030, posting an 8.2% CAGR. This growth signals more than just retail expansion. The market growth is increasingly underpinned by structural shifts in how goods are identified, tracked, and regulated across global supply chains.

Key contributors to barcode printer market expansion include:

- • Continued growth of e-commerce fulfillment and third-party logistics (3PL) networks

- • Expansion of warehouse automation and inventory digitization initiatives

- • Regulatory mandates for traceability in healthcare, food, and chemical labeling

- • Rising SKU complexity in retail and manufacturing environments

Key Trends Shaping the Barcode Label Printer Market

Market dynamics are reshaping deployment models, system integration strategies, and hardware performance standards. The following analysis highlights the key barcode label printer market trends shaping the industry.

Automation and Warehouse Digitalization Driving Barcode Printer Demand

Warehouse automation drives the most significant surge in demand, specifically within e-commerce fulfillment and 3PL networks.

Modern warehouses increasingly rely on barcode labeling at inbound, storage, picking, packing, and outbound stages. In parallel, large logistics hubs and major ports are deploying AIDC systems at scale, driving strong demand for hybrid barcode and RFID solutions to support high-volume, multi-modal operations.

Printers are no longer standalone devices but have become integral components of larger WMS- and ERP-driven systems.

Regulatory-Driven Labeling and Traceability Requirements

Compliance is now a structural demand driver, not just a guideline. Healthcare, food, chemical, and electronics sectors face strict mandates for standardized, durable, and verifiable labeling.

For example, U.S. FDA UDI regulations and EU MDR requirements mandate permanent, machine-readable identifiers—often 2D codes—on medical devices and packaging to enable lifecycle-level traceability.

These regulations elevate labeling from a cost center to a risk-control mechanism, reinforcing long-term demand for robust barcode printing solutions capable of producing compliant labels under diverse environmental conditions.

Integration of Barcode Printers with Enterprise and IoT Systems

Another defining trend in the barcode printer market is deeper integration with enterprise systems. Barcode printers are increasingly expected to work seamlessly with ERP, MES, WMS, and cloud-based device management platforms. This shift emphasizes software compatibility, remote monitoring, and lifecycle manageability alongside traditional hardware performance.

Sustainability Initiatives and Linerless Label Adoption

Additionally, environmental pressure is influencing labeling strategies worldwide. Sustainability-focused initiatives have accelerated interest in linerless labels, waste reduction, and material efficiency. While adoption rates vary by region and application, sustainability considerations are becoming a strategic procurement factor, shaping how organizations evaluate barcode printing solutions.

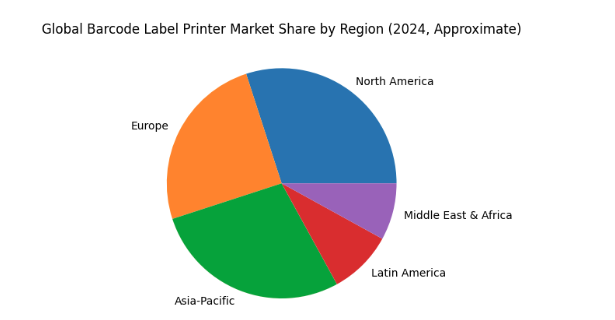

Barcode Label Printer Market Share Breakdown (By Region)

Regional market share varies primarily with logistics maturity, industrial structure, and regulatory intensity—making demand concentration highly uneven across major regions.

North America

30.1% Global Share (2024)

North America represents the largest regional share of the global barcode label printer market. According to Grand View Research, the region accounted for approximately 30.1% of global market revenue in 2024.

The region’s strong market position is supported by advanced warehouse automation, dense third-party logistics (3PL) networks, and early integration of barcode printing into enterprise systems. These factors continue to sustain demand for industrial-grade and high-reliability barcode printers across North American operations.

Asia-Pacific (APAC)

Asia-Pacific is emerging as one of the fastest-growing markets for barcode label printers worldwide, driven by rapid expansion of manufacturing capacity, e-commerce fulfillment centers, and supply chain digitization initiatives in major economies such as China and India.

This growth is reinforced by strong demand for industrial and mobile barcode printing solutions to support logistics, retail modernization, and compliance labeling. Many companies in the region are accelerating automation investments, which in turn bolsters demand for integrated barcode printing systems at scale.

Europe

Europe barcode label printer market demand is driven by manufacturing intensity, regulatory enforcement, and logistics modernization.

Western European economies such as Germany remain key demand centers due to sustained investment in automotive, machinery, chemicals, and industrial production, where industrial-grade barcode printing is deeply integrated into manufacturing and outbound logistics workflows.

Regulation is a defining force across the region. EU requirements in pharmaceuticals, food safety, and anti-counterfeiting increasingly mandate 2D codes, including Data Matrix and QR codes, on product packaging and labels. These mandates raise baseline requirements for higher-resolution printing, precise variable data handling, and durable label performance, making compliance a core capability rather than an optional feature in many European deployments.

Latin America

Latin America represents a moderate-growth but structurally improving market for barcode label printers, with demand concentrated in Brazil, Mexico, and key logistics corridors. Growth is primarily driven by retail chain expansion, e-commerce fulfillment, and local manufacturing, where barcode labeling supports shipment identification, inventory accuracy, and outbound compliance.

In addition to commercial drivers, regulatory initiatives in pharmaceuticals, tobacco, and selected consumer goods categories are accelerating adoption of serialization and traceability systems across parts of the region.

Latin America represents a moderate-growth but structurally improving market for barcode label printers, with demand concentrated in Brazil, Mexico, and key logistics corridors. Growth is primarily driven by retail chain expansion, e-commerce fulfillment, and local manufacturing, where barcode labeling supports shipment identification, inventory accuracy, and outbound compliance.

Middle East & Africa (MEA)

The Middle East and Africa region, led by Gulf Cooperation Council (GCC) countries such as the United Arab Emirates and Saudi Arabia, is gradually increasing its adoption of barcode printing solutions across logistics, customs operations, and regulated industries like pharmaceuticals.

Across MEA, a significant portion of warehouses, distribution centers, and public-sector operations are still transitioning from manual or semi-automated labeling toward standardized barcode-based systems. This ongoing transition creates incremental demand for barcode printers as part of broader AIDC adoption programs, especially in logistics hubs, free-trade zones, healthcare supply chains, and government-led digitalization initiatives.

Overall, regional demand patterns show a clear split between mature markets driven by automation and compliance, and emerging markets driven by infrastructure build-out and digitization.

Partner with IDPRT

IDPRT is an experienced AIDC hardware supplier based in China, supporting global customers with barcode printers, RFID printers, barcode scanners, and mobile data terminals (PDAs) designed for real-world operational environments.

Desktop Barcode Printer

Mobile Barcode Printer

Industrial Barcode Printer

RFID Printer

RFID Reader

Handheld Barcode Scanner

From high-volume warehouse labeling to compliance-driven medical and industrial applications, IDPRT focuses on stable performance, long service life, and integration flexibility in its barcode printers.

Our solutions are engineered to fit seamlessly into existing WMS, ERP, MES, and IoT ecosystems—helping customers reduce operational risk, control total cost of ownership, and scale AIDC deployments efficiently across regions and use cases.